by W. Elliott Brownlee

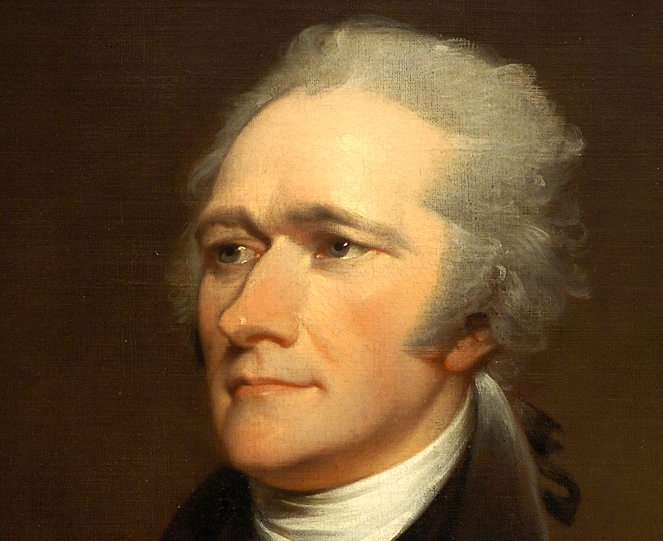

In 1789, Congress created the Department of the Treasury, including the cabinet post of secretary of the Treasury, and required the secretary to report directly to Congress. President George Washington appointed Alexander Hamilton as the first secretary of the Treasury.

During 1790 and 1791, Hamilton embarked on an ambitious plan of economic nationalism. He intended the plan to solve the economic problems that had plagued the United States since the American Revolution and to provide the means to defend the new republic. Beginning in January 1790 with the “Report on the Public Credit,” he advanced his plan in a series of reports to Congress. His plan contained seven central elements.

Foreign Debts

The first element called for paying off in full the loans that foreign governments had made to the Continental Congress during the Revolution. In 1790 the principal on these loans amounted to roughly $10 million. The United States owed two-thirds of these debts to France, one-third to the Netherlands, and a small amount to Spain. In addition, unpaid interest of about $1.6 million had accrued. Hamilton proposed that the federal government pay the interest out of tax revenues and borrow, over a fifteen-year period, enough capital to repay the principal of the loans. No one in Congress or the administration challenged Hamilton’s arguments that the United States had a legal and moral obligation to pay off these debts, and that it had to do so in order to establish the credit of the United States, and its citizens, in European financial markets.

Domestic Debts

The second element was more controversial. This was Hamilton’s proposal for repaying the debts that the Continental Congress and the Confederation government had incurred by borrowing domestically—that is, from individuals and American state governments. These debts, amounting to about $42.4 million, had resulted from the selling of bonds to supporters of the Revolution and the issuing of various notes to pay soldiers and farmers and merchants who had supplied the revolutionary armies. This proposal consisted of two parts.

First, Hamilton recommended “redemption” of the debt at full value. By “redemption,” he meant offering to trade the complicated morass of notes and bonds of varying durations and interest rates for new, long-term federal bonds. These new securities would pay fixed, attractive rates of interest. Second, Hamilton recommended that the federal government maintain this new debt as a permanent feature of the fiscal landscape. To demonstrate the commitment of the federal government to maintaining the value of this permanent debt, Hamilton proposed creating a “sinking fund,” based on the method used by the British government to manage its debt. The Treasury would establish this fund within a national bank (which Hamilton promised to propose soon) and supply it with surplus revenues of the post office and the proceeds of a new European loan. A management committee consisting of the secretary of the Treasury, the vice president of the United States, the speaker of the House, the chief justice, and the attorney general would then use this fund to purchase public securities if they circulated below their par value. In so doing, the committee would maintain a floor under the price of these securities.

Hamilton believed that the two parts of the plan would work together. The plan would create a class of wealthy citizens who, because they were long-term creditors of the new national government, would be loyal to it and take an active interest in its affairs. As a consequence, the central government would be strong and able to finance wars or fund major national projects. In addition, the permanent debt, because its owners could readily convert it into money or other assets, would provide capital to meet the needs of an expanding economy.

Members of Congress generally agreed with Hamilton that the new federal government had a legal obligation to pay the domestic debts that the Confederation government had incurred. Article VI of the Constitution provides that “All Debts contracted… before the Adoption of this Constitution, shall be as valid against the United States under this Constitution, as under the Confederation.” But many in Congress, including James Madison, argued that the federal government ought to negotiate down the domestic debts and take into account the interests of those who had first owned the securities. Critics pointed out that the inflation of the war years and the depressed conditions of the 1780s had forced many of the original owners, including revolutionary war soldiers, to sell them at substantial losses. The speculators, including wealthy American merchants, Dutch investors, and even British investors, who had bought these deeply discounted notes, stood to reap huge windfall gains under Hamilton’s redemption program. The critics wanted Hamilton to scale back the redemption of debts held by speculators and provide some compensation to the original owners of the domestic debt. Madison proposed offering speculators only “the highest price which has prevailed in the market” and distributing the savings to the original owners.

Hamilton, however, believed that the federal government would be unable to determine who had been the original owners of federal securities. Moreover, he was convinced that the best way of demonstrating the trustworthiness of the federal government was to pay back the debts at something close to their full value. This demonstration was necessary, Hamilton was certain, in order for the federal government to borrow in the future without having to pay excessive rates of interest. Hamilton was persuasive, and nearly half of the members of the House of Representatives owned the domestic debt that Hamilton sought to redeem. In February 1790, the House voted down Madison’s plan.

Debts of the States

The third element of Hamilton’s policies was the proposal that the federal government take over the $25 million in debt that the state governments had accumulated during the Revolution. With this “assumption” program, Hamilton sought to strengthen further the nation’s financial reputation, to bolster the nation’s stock of capital, and to enhance the financial power of the federal government.

All of the states had debts from the war, but their efforts to pay off the debts had varied greatly. Massachusetts and South Carolina had been sluggish in paying off their war debts and had much to gain from assumption. Four southern states—Georgia, North Carolina, Virginia, and Maryland—had been aggressive in paying off their debts. For them, assumption threatened to be costly, requiring them to subsidize the plan through new federal taxes.

Secretary of State Thomas Jefferson was worried about the cost of assumption, and about Hamilton’s political intentions. To Jefferson, assumption threatened the Republic by dangerously centralizing financial power. Madison agreed with Jefferson, and in April 1790 they were able to defeat assumption in its first test within the House of Representatives. By July, however, Madison and Jefferson had softened their opposition. For one thing, Hamilton had lowered the assumption program to $21.5 million and agreed to adjust the accounts so that Virginia’s net payments to the federal government would be zero. For another, he agreed to support moving the nation’s capital from New York to a site in Virginia on the banks of the Potomac River after a ten-year interlude in Philadelphia. Madison and Jefferson hoped the move would stimulate economic development of their state, weaken the kind of ties that Hamilton sought to promote between the federal government and the financial elites of New York and Philadelphia, and bring the government more under the influence of Virginia’s leaders. In addition, Madison and Jefferson became worried that if the fledgling government failed to pass a funding bill the divergence of sectional interests might break up the new union. They allowed southern votes to shift to support for Hamilton’s plan for assumption of the state debts, and in July it won congressional endorsement in what historians later called the Compromise of 1790.

Taxation

The fourth central element of Hamilton’s financial program was taxation. On 4 July 1789, even before Congress had created the Treasury, President Washington signed into law a tariff act designed to raise revenues for the new government. The act established a complex set of duties on imports, rebates for re-exported goods, and special favors for imports carried in American vessels. The act yielded more than $1 million per year, but this was far less than the $3 million that Hamilton estimated would be required each year for interest payments to the holders of federal debt. Therefore, in January 1790 in the “Report on the Public Credit,” Hamilton recommended an increase in tariffs and the introduction of internal taxation in the form of an excise tax on distilled spirits. However, he stopped short of proposing direct taxes—by which he, and the Constitution, meant poll taxes and property taxes. He worried that these taxes would create a popular backlash, and he wanted to encourage state cooperation with his financial program by leaving direct taxation as the exclusive province of state and local governments.

In August 1790, Congress passed four separate acts that adopted, with only minor changes, Hamilton’s proposals for paying off foreign debts, redeeming domestic debts, assuming state debts, and increasing tariffs. At the same time, Congress asked Hamilton to submit a formal proposal for establishing the tax on distilled spirits. In December 1790, Hamilton advanced a formal proposal for the tax and, in March 1791, with little debate, Congress adopted it in the Excise Act of 1791.

The Bank of the United States

In December 1790, Hamilton also proposed the fifth element in his financial plan: the federal chartering and funding of a powerful institution—a national bank, which would be called the Bank of the United States and modeled to some extent on the Bank of England. The bank was to be a commercial bank, which was a rare institution in America. State governments had chartered only four of them. Like these four, the Bank of the United States would accept deposits, issue bank notes (as loans or as evidence of deposits), discount commercial paper, and loan short-term funds to the government. But Hamilton wanted more. The Bank of the United States, in Hamilton’s view, would be very different from the other commercial banks. One difference would be its sheer size. Hamilton proposed capitalization for the bank that would make it five times the size of all the other commercial banks combined. This meant that the bank could expand significantly the size of the nation’s money supply and thus enhance economic activity.

In contrast to the other banks, the Bank of the United States would conduct business on a national scale and thus be able to expedite the movement of federal funds around the nation. In an era of slow communication, this ability promised to enhance the efficiency and power of both the federal government and the nation’s capital markets. Another difference, the participation of the federal government as a partner in the bank’s ownership, would enable the government to share in the returns from the bank’s operations and thus enhance federal revenues. A final difference, the requirement that investors in the bank use long-term obligations of the federal government to purchase bank stock, would support the price of government bonds. Hamilton meant for these differences, taken as a package, to reinforce other elements in his economic program.

In February 1791, Congress passed a bill that adopted most of Hamilton’s specific ideas for the new bank. Congress provided for a twenty-year charter, a pledge that the government would not charter another bank during that period, a capitalization of $10 million, 20 percent ownership by the federal government, a requirement that 75 percent of the stock subscribed by private parties be purchased with United States securities, and a provision for locating the headquarters of the bank in Philadelphia.

During the congressional debates over the bank, Madison and other Virginians became concerned that locating the bank in Philadelphia for twenty years might interfere with moving to the permanent capital in ten years. They demanded that Congress reduce the term of the charter to ten years, but Pennsylvania supporters of the bank blocked the reduction. Madison then claimed that Congress had no power to charter the bank, or any corporation. In so doing, he advanced a “narrow” interpretation of the powers of Congress under the Constitution. While Congress rejected Madison’s claim, President Washington took his argument seriously. In addition, Washington worried about jeopardizing the move of the capital to the Potomac site, which was near his home of Mount Vernon. However, Hamilton made a powerful case to Washington that the Constitution implied the power to create corporations and this “broad” interpretation swayed the president, who signed the bill creating the Bank of the United States.

The Mint

In January 1791, while the Bank of the United States was still under debate, Hamilton submitted the “Report on the Establishment of a Mint.” The creation of a mint, the sixth element of his economic program, followed the call of the Constitution for a national coinage. Hamilton’s goal was to create a system of coinage that would be uniform across the United States and provide monetary stability. Uniformity and stability would promote commerce, enhance the credit worthiness of the United States, and protect the value of tax revenues. Hamilton personally preferred gold coinage but he recognized the political reality that many members of Congress worried about the shortage of gold and the potential deflationary impact of a gold standard. Hamilton proposed, instead, a bimetallic standard based on the minting of both gold and silver coins. Both gold and silver coins would be legal tender, and the mint would buy gold or silver at an official ratio of fifteen ounces of silver to one ounce of gold. The most common coin in circulation was the Spanish silver dollar, and it had provided the unit with which the new nation valued its debts. To ease the transition, Hamilton recommended adopting the dollar as the basic unit for the coinage of the new republic, and keeping the silver content of the new dollar close to that of the Spanish one. In addition, to facilitate small transactions, he recommended an elaborate fractional coinage. Congress adopted almost all of Hamilton’s proposals in the Coinage Act of 1792.

Promotion of Manufacturing

In January 1791 the House of Representatives asked Hamilton to prepare a plan for the seventh element of his program: “the encouragement and promotion of such manufactories as will tend to render the United States independent of other nations for essentials, particularly for military supplies” (Journal of the House of Representatives of the United States, 15 January 1791, quoted in Jacob E. Cooke, ed., The Reports of Alexander Hamilton, p. 115). In December of that year, Hamilton responded with the last of his reports, the “Report on Manufactures.” Hamilton went beyond the charge to consider preparations for war; he recommended an ambitious, national program of industrial advancement. Hamilton made a case that, complementing America’s vast agricultural sector, manufacturing, and especially the introduction of machine production, would contribute to “The Produce and Revenue of the Society” (Alexander Hamilton, “Report on Manufactures,” quoted in Cooke, ed., The Reports of Alexander Hamilton, p. 127). He concluded that the development of modern manufacturing in America would be difficult because of “fear of want of success in untried enterprises” (Hamilton, “Report on Manufactures,” p. 140) and competition from European manufacturers, who had reaped the benefits of the mercantilist policies of European governments.

To overcome these obstacles, the federal government should, Hamilton argued, adopt a broad range of policies that would encourage Americans to spend their money and their energy on the advancement of technological change in industry. The policies included, in addition to the public finance measures that Hamilton had already championed successfully, tariffs crafted to protect new industries; exemptions from tariffs for raw materials important to industrial development; prohibitions on the exporting of raw materials needed by American industry; promotion of inventions; award of premiums and bonuses for “the prosecution and introduction of useful discoveries” by a federal board; inspection of manufactured goods to protect consumers and enhance the reputation abroad of American manufacturing; and improvement of transportation facilities.

In response, in March 1792, Congress passed most of the tariff program Hamilton had proposed: increases in tariffs on manufactured goods, including the iron and steel of Pennsylvania, and reductions in tariffs on raw materials. However, Congress rejected the rest of Hamilton’s policy for manufactures. Jefferson and Madison hated the prospect of an industrial revolution and believed that Hamilton had already gained excessive power and might even be plotting to replace the Republic with a monarchy. (Their suspicion was incorrect.) In addition, prominent merchants feared that Hamilton’s industrial program would disturb their profitable trade with Great Britain.

The Aftermath

Some of Hamilton’s economic policies, especially the creation of the Bank of the United States and excise taxation, stimulated the development of organized opposition to the Washington administration and led to the formation of what became the Republican Party of Thomas Jefferson and James Madison. Particularly troublesome to Hamilton was the Whiskey Rebellion in 1794, in which thousands of farmers in western Pennsylvania challenged the legitimacy of the excise tax on distilled spirits. They waved banners denouncing tyranny and embracing “liberty, equality, and fraternity,” the ideals of the French Revolution. With Hamilton’s enthusiastic support, President Washington mobilized 15,000 troops to suppress the rebellion.

Hamilton’s economic policies may have undermined the future of the Federalist Party, but they established a fiscally strong federal government, just as Hamilton had planned. In 1793, under Hamilton’s tax regime, the federal government collected enough revenue to pay off interest on the public debt ($2.8 million in 1793), fund the army and navy (over $1 million in 1792), and still balance the federal budget. By 1795 the regular payment of interest enabled the Treasury to float new loans in the Netherlands and pay off its debts to Spain and France. Meanwhile, Hamilton redeemed the domestic debts, including the debts of state government, and the new securities circulated at close to par value. Vigorous capital markets, in turn, contributed to a dramatic economic expansion that began in the early 1790s and continued for a decade. Finally, Hamilton’s economic policies established a model of a central government that worked creatively, positively, and effectively to unleash the nation’s economic energies. For the next two centuries, Hamilton’s model would influence the development of the federal government as an integral part of American capitalism.

Bibliography

Brown, Roger H. Redeeming the Republic: Federalists, Taxation, and the Origins of the Constitution.Baltimore: Johns Hopkins University Press, 1993. Emphasizes the role of fiscal concerns in the movement for the Constitution.

Bruchey, Stuart. Enterprise: The Dynamic Economy of Free People. Cambridge, Mass.: Harvard University Press, 1990. Contains an incisive assessment of Hamilton’s program.

Cooke, Jacob E., ed. The Reports of Alexander Hamilton. New York: Harper and Row, 1964.

Elkins, Stanley, and Eric McKitrick. The Age of Federalism: The Early American Republic, 1788–1800.Oxford and New York: Oxford University Press, 1993. Best book on the rise and fall of the Federalists.

Ellis, Joseph J. Founding Brothers: The Revolutionary Generation. New York: Knopf, 2001. Contains insightful essay on the Compromise of 1790.

Ferguson, E. James. The Power of the Purse: A History of American Public Finance, 1776–1790. Chapel Hill: University of North Carolina Press, 1961. Best history of the financing of the American Revolution.

McDonald, Forrest. Alexander Hamilton: A Biography. New York: Norton, 1979. Intertwines Hamilton’s ideas with the development of his political career.

Mitchell, Broadus. Alexander Hamilton: The National Adventure, 1788–1804. New York: Macmillan, 1962. Contains lucid and detailed discussion of Hamilton’s program.